Like so many millennials, I started saving late, and catching up hasn’t been easy

It has taken me years to take saving for retirement seriously. Too many years.

More than a decade ago, while working for a small newspaper in northeast Ohio, my co-workers and I attended a presentation where a well-dressed man with a monotone voice went into detail about our employer’s new retirement-savings plan—the investment options, fees, outlook and the company match. He used words like “financial headwinds,” and “fully vested” and whipped out pie charts to zhuzh things up.

When he asked me if I had any questions, I said “no.”

That’s because, at the time, the whole thing struck me as off-key. Here I was, age 25 and making $25,000 a year, driving an unreliable car and eating instant noodles most nights for dinner. This guy wanted me to envision what my life would be like 40 years into the future, while my glasses were being held together by super glue.

After the presentation, some older—and wiser—co-workers did convince me to put enough into the 401(k) to get the company match. But several months later, I liquidated that anemic retirement account to pay bills. I felt guilty about it.

I’m now 37 years old—and I’m playing catch-up.

Like so many people of my generation, I’ve fallen behind in my retirement savings. The combination of entering the workforce during the financial crisis and the burden of student debt has put me and many others behind from the beginning. And the higher cost of living over the past few years has only made saving harder. Once you’re behind a little, it’s easy to keep falling farther and farther behind.

So now, I can’t help but wonder: Will I need to work into my 70s? And, what can I do to get back on track?

“Millennials came of age during the great financial crisis. They saw their parents lose their jobs and their incomes,” says Megan Miller, senior wealth adviser and managing director at MAI Capital Management. “They also have the highest student-loan debt than any other generation. It’s a very challenging position to be in.”

Stumbling out of the gate

It seems inconceivable to me, but millennials—those of us who grew up on the Teenage Mutant Ninja Turtles, boy bands, Harry Potter and flip phones—are nearing middle age. Suddenly, retirement doesn’t seem like such a distant thing.

The problem for many of us is that we stumbled out of the gate financially in young adulthood and have been put through the wringer ever since.

After that first foray at age 25, I did begin squirreling away some money into a 401(k) in my late 20s. Admittedly, I did it to meet my company’s match because, as financial pros often say, it was “free” money. While the match encouraged me to save more than I otherwise would have, my earnings were still relatively low.

And with student-loan payments, car payments, healthcare, rent and other expenses, it was nearly impossible for me to contribute more to my retirement than I already was.

During much of the pandemic, I worked for a company that didn’t offer retirement benefits at first. This put me even further behind.

My friend Jamie and his wife, Anna, know that feeling well. They spent their early working years in restaurants on North Carolina’s Outer Banks, so they didn’t start saving for retirement in earnest until their late 20s, after establishing some financial stability.

Since then, they’ve bought a home, had two children and started small businesses. Still, the amount they set aside for retirement savings maxes out at a couple of hundred dollars a month. “There’s never been a moment where we feel 100% confident to spare more money because life happens—we had kids, if something happened to our house, or we changed jobs,” says Jamie, who is now 36.

For Jamie and Anna, it’s a case of making tough choices. “There was a period where we were close to pulling money out of our retirement” savings, he says. “Do we sacrifice our retirement to pay for our kids’ college? We don’t know what’s best.”

Unfortunately, I’ve dipped into my retirement several times over the years. I once took out $10,000 from my IRA for a down payment on my Cleveland home. Another time, I withdrew a couple of thousand dollars from my Roth IRA to help pay for a move to New York. While I didn’t pay withdrawal penalties in either case, I realize that I have missed out on potential investment gains—and the power of compound interest—from that money I withdrew.

But I’m not alone. A 2023 survey by Betterment found that of the investors who withdrew money from retirement accounts, 30% were millennials and 27% were from Generation Z.

Still behind

Today, I have a Roth IRA, a traditional IRA (rollovers from a previous employer) and a 401(k) dedicated to a target-date fund.

My wife’s workplace doesn’t offer any retirement benefits, so I try to put away a little more on my end to make up the difference. Currently, 7% of my paycheck goes into my 401(k). It’s the most I’ve ever dedicated to retirement savings. I also contribute around $100 a month to the IRA.

But I’m still behind.

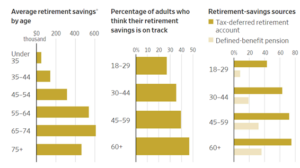

According to conventional wisdom, I should have at least three times my salary saved up for retirement by the time I’m 40. I have only 20% of that saved.

Fidelity Investments, the servicer of my retirement accounts, estimates that my retirement income will be around $9,400 a month if I keep saving at my current level, a rating it calls “fair.” That estimate includes my 401(k), but also Social Security, a safety net many millennials are doubtful will be there when it’s our turn to retire. Though it might seem like a nice chunk monthly, inflation, historical returns and other factors could greatly affect my bottom line.

Our retirement income would be around 60% of our preretirement income, if I continue to save at my current clip with my current earnings. This also assumes I don’t make any more withdrawals or take a 401(k) loan. We would be better off if my income continues increasing, of course.

Quinn, a friend from my college days, says he started contributing regularly to his 401(k) in earnest at age 33. He spent 11 years in the Air Force and left without retirement savings. In his civilian life, he worked 3½ years for a company that offered a pension, but only after five years of service. He left before that, however, to pursue a higher-paying job.

Now 35, he works as a power systems service manager in northeast Ohio and is currently the sole earner in his family. “I do feel like I’m playing catch-up even though I’m doing better than some other people,” says Quinn, who is married and has an 8-year-old daughter. But “I think it’s all going to come together,” he adds.

What’s my plan?

So, what could my retirement look like—and how do my wife and I realistically boost our retirement savings to get there?

Miller, the wealth adviser, suggests that I set aside 50% of every pay raise I get until I’m saving 15% of my income. “You still have a long road of retirement accumulation,” she says.

For now, I’m planning on keeping my retirement-savings rate (minus any raises) where it is. Unfortunately, my wife and I don’t have as much emergency savings as we would like. And with our cost-of-living still high, I can’t imagine dialing back my take-home pay any further.

Hopefully, we’ll be more stable in the near future, which will allow me to stash more in my 401(k). Ideally, I will increase my savings by 1 percentage point each year.

But Miller also got me thinking about something I had never even considered, when she asked the question: “Where do you want to be in retirement?” She says the two most important aspects of retirement to consider (aside from the savings goals) are time and place. Where we want to retire, and when.

For some inspiration, I reached out to my mother, who is nearing retirement herself. She’s a younger baby boomer who plans on having a modest, but adventurous, retirement. “I want to sell everything, buy a camper and travel the country,” she says.

Despite several financial setbacks, my mother is confident that her savings, and Social Security, will support her. And she’s open to working part time in retirement, more for mental stimulation than the earnings, she says.

So what is my plan? Maybe my wife and I will settle in a modest beach house (no ocean view for us), in North Carolina. Or maybe a cabin in the Appalachian Mountains has our names on it. Florida? Not my speed.

As for timing? My current savings rate hasn’t really put me in a position to consider early retirement like some of my cohort. I’m happy to continue working as long as my health allows, even if it’s part-time.

Thirty years is still a long time. In other words, I have a lot of time to think about it.

Until then, I’ll keep saving.

Source: Wall Street Journal