private-equity investors have poured billions into healthcare but often game the system, hurting both doctors and patients

Consolidation is as american as apple pie.

When a business gets bigger, it forces mom-and-pop players out of the market, but it can boost profits and bring down costs, too. Think about the pros and cons of walmart and “every day low prices.” in a complex, multitrillion-dollar system like america’s healthcare market, though, that principle has turned into a harmful arms race that has helped drive prices increasingly higher without improving care.

Years of dealmaking has led to sprawling hospital systems, vertically integrated health insurance companies, and highly concentrated private equity-owned practices resulting in diminished competition and even the closure of vital health facilities. As this three-part heard on the street series will show, the rich rewards and lax oversight ultimately create pain for both patients and the doctors who treat them. Belatedly, state and federal regulators and lawmakers are zeroing in on consolidation, creating uncertainty for the investors who have long profited from the healthcare merger boom.

Consider the impact of massive private-equity investment in medical practices. When a patient with employer-based insurance goes under for surgery, the anesthesiologist’s fee is supposed to be determined by market forces. But what happens if one firm quietly buys out several anesthesiologists in the same city and then hikes the price of the procedure?

Such a scheme was allegedly implemented by the private-equity firm welsh, carson, anderson & stowe and the company it created in 2012, u.S. Anesthesia partners, according to a federal trade commission lawsuit filed last year. It started by buying the largest practice in houston and then making three further acquisitions, eventually expanding into other cities throughout the state of texas. In each location, the lawsuit alleges, usap pursued an aggressive strategy of eliminating competitors by either acquiring them or conspiring with them to weaken competition.

As one insurance executive put it in the ftc lawsuit, usap and welsh carson used acquisitions to “take the highest rate of all…and then peanut butter spread that across the entire state of texas.” in may, u.S. District judge kenneth hoyt dismissed the ftc’s unusual step of charging the private-equity investor, welsh carson, but allowed the case against usap to proceed.

Dr. Scott holliday, a board member at usap, said the company believes that the ftc’s claims are without merit and is confident in their position. “in the meantime, we will continue to focus on caring for the patients we serve in texas and other communities across the country,” he said in written comments to heard on the street.

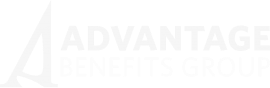

Over the past decade, private equity has spent hundreds of billions of dollars acquiring healthcare businesses from emergency care to anesthesiology to nursing homes. Where private equity has gone, studies show, prices have tended to increase.

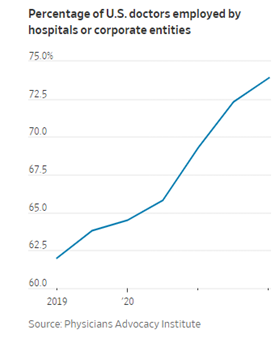

Such so-called rent-seeking behavior is a unique feature of the american healthcare system. Nowhere else in the world do so many healthcare dollars encounter so few mechanisms to limit profiteering. The u.S. Commercial market relies on negotiations between insurers and medical providers to deliver the best possible quality and price for patients. Increasingly, though, it is becoming less competitive by design.

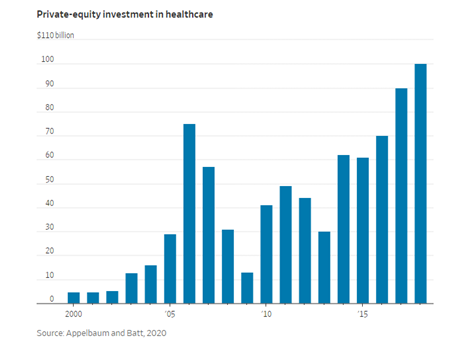

In the u.S., many doctors used to work for physician-owned businesses. These days, about three-quarters work for a hospital or a corporate owner. As for your hospital, a private-equity firm or a larger medical system probably owns it.

There are massive incentives to consolidate. At nearly $5 trillion, u.S. Healthcare’s gross domestic product would rank it third in the world if it were a country. And there is a reason smaller practices want to sell: regulations have become increasingly cumbersome, and dealing with insurers as a small entity isn’t a rewarding experience.

One particularly troublesome aspect of the private-equity marriage with healthcare is that it can put businesses that are essential to society at risk. An example is the crisis engulfing steward health care system. The hospital chain was formed by the private-equity firm cerberus capital management when it first bought six struggling massachusetts hospitals in 2010. A 2016 sale-leaseback agreement with the hospital landlord medical properties trust allowed cerberus to receive hundreds of millions of dollars in dividends and helped steward expand through acquisitions.

The strategy allowed steward to grow but left it with diminished financial resources, arguably paving the path to one of the biggest hospital bankruptcies in decades. Before filing for chapter 11 protection in may, steward faced a mountain of lawsuits by vendors over unpaid bills, including a pest-control company hired to remove about 3,000 bats last year at one of steward’s florida hospitals.

There are plenty of cases in healthcare of private-equity investors steering a business they bought through a transition of rapid performance improvement by streamlining billing and scheduling, later selling it for a profit—the same efficiency they can bring to other businesses.

“but the fact that the other strategies are so rich,” noted mark miller, executive vice president of healthcare at arnold ventures, “makes it hard for private equity to resist them.” he said keeping tabs on private-equity investments is a great way for the philanthropic organization founded by the former energy trader john arnold to look for market failures.

In the texas case, usap allegedly exploited a fact that pervades healthcare: surgery isn’t a discretionary purchase like a pair of shoes or a television, so payers and patients often have no choice but to accept exorbitant charges. What’s more, consumers aren’t cost-sensitive because their employers and health plans cover most of the charges and because they lack pricing information to make a decision. Before a patient goes under, she has no idea how much the anesthesia bill will be. As a usap executive succinctly put it in perhaps the most memorable line of the ftc lawsuit: “cha-ching!”

Usap might have hoped to escape regulator scrutiny because the ftc had never pursued a case against roll-ups in healthcare. Under u.S. Law, individual transactions valued below a threshold of about $120 million don’t trigger merger filings and might not even be publicly announced. That makes it harder for regulators to challenge such deals, though an ftc official said that is now changing. The texas anesthesiology case is intended to have a deterrent effect by serving as “a warning to businesses that such deals shouldn’t even leave the boardroom,” the official said in an interview.

Political action is also intensifying. Statehouses across the country are enacting laws to curtail private-equity healthcare acquisitions, while congress and regulatory agencies are probing the effects of private-equity investments. In may, the justice department created a task force focused on healthcare monopolies and collusion.

Alongside major hospitals and health insurers, private-equity firms have gone on a healthcare buying binge in recent decades, claiming that their acquisitions will ultimately make healthcare more affordable. All the while, americans’ medical bills have gone nowhere but up.