high earners get nearly half the ‘free money’ employers contribute to retirement plans

One of the biggest selling points of 401(k) retirement plans is the chance to earn “free money” in matching contributions from your company. This perk mainly benefits high earners, a new study suggests.

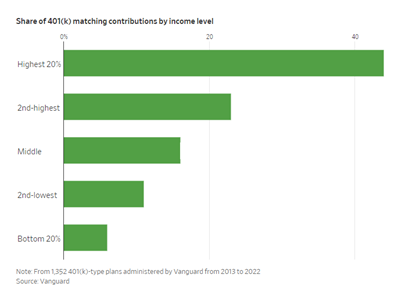

Nearly half of the $200 billion companies contribute to workers’ 401(k)s goes to the top 20% of earners, research by vanguard group found. The lowest-earning workers get 6% of the money.

The 401(k) has risen to become the backbone of how many americans plan for retirement, replacing pensions that were more popular in previous decades. Along with the company match, 401(k) plans offer tax advantages designed to help people build a comfortable nest egg.

But economists, researchers and others have said these plans are falling short of what is needed to provide a secure retirement for all americans.

In vanguard’s research, the company found employer contributions, including the match, have been a boon to the high earners already most likely to have saved for retirement. Fiona greig, global head of investor research and policy at vanguard group, said new formulas for company matches are needed to ensure greater benefit for all workers.

Many match formulas are “not serving low-income workers for whom these match dollars would be more material.”

Federal policy requires 401(k) plans to be equitable, and plans are subject to annual review to make sure they don’t disproportionately favor top earners. Companies can get an exemption from the fairness tests by offering certain matches or contributions.

Some companies are using alternative approaches, including a match that caps payments at a set dollar amount, which the study finds more equitably distributes employer contributions.

where matches work—and miss the mark

Companies aren’t required to make 401(k) contributions, but most do make a contribution of some kind to encourage workers to save.

These contributions add up to 24% of the wealth in retirement plans, according to taha choukhmane, a co-author of the study and an assistant professor at mit’s sloan school of management.

Some companies give all employees a set amount each year, say 3% of pay, even if they don’t contribute a dime. Most provide a matching contribution, which rewards those who save on their own. Some offer both.

The most common approach among plans vanguard administers is to match half the amount workers put into their accounts, up to 6% of pay.

When the match is based on a percentage of pay, higher earners typically receive more. If a company matches up to 5% of pay, someone earning $200,000 could get as much as $10,000, versus $5,000 for a $100,000 salary.

The vanguard study shows top earners often receive a bigger share of 401(k) matching dollars than their share of pay. On average, the top 20% of earners took home 39% of the income but received 44% of their employers’ 401(k) contributions, according to the study, which looked at 1,352 plans vanguard administered from 2013 to 2022.

The results indicate matching dollars often exacerbate pay inequity, said greig, who said this occurred at two-thirds of the plans studied.

One reason the top 20% fare so well is that they are far more likely than lower-paid workers to participate in 401(k) plans and save enough to earn a full matching contribution.

The study looked at the 10 most popular matching formulas and found all but one disproportionately rewarded the top 20% of earners with a higher share of matching dollars than income.

alternative formulas

Greig said one way companies can help lower-paid workers get more matching dollars is by automatically enrolling them at a savings rate that captures the full matching contribution.

The formula that does the best job of more equitably distributing employer contributions caps them at a set dollar amount, the study found—something used by 4% of vanguard plans.

With dollar caps, the top one-fifth of earners got about 33% of the matching contributions on average, compared with 35% of pay, the study said.

costco matches half of employees’ annual 401(k) savings up to a $500 cap. The company also contributes 4% to 9% of eligible compensation when employees meet certain tenure criteria. For example, those with one to three years at the company get 4% of eligible earnings, whether they save or not.

microsoft switched its matching formula to a dollar cap in 2016 to entice its lower-paid employees, then in the $75,000 to $100,000 range, to save more, said fred thiele, vice president of global benefits and mobility.

under the old formula, the company matched half of employees’ contributions up to 6% of pay. But lower earners disproportionately saved at around 6% of pay, said thiele.

microsoft currently matches 50 cents of every dollar an employee contributes, up to $11,500. To get the full $11,500, an employee must contribute the $23,000 maximum the internal revenue service allows workers to put into tax-advantaged 401(k) accounts. (microsoft raises its match annually to keep it at half the irs contribution limit, which rises with inflation.)

Lower-paid workers received about three-quarters of the extra dollars microsoft spent on its matching program when it adopted the new formula, thiele said. It currently spends about $1 billion a year on matching contributions.

Under the current formula, someone making $100,000 who contributes 15% of pay would get $7,500. That is $4,500 more than the $3,000 that person would have received under the old formula.

An employee earning $300,000 who contributes the $23,000 limit would get $11,500. That is $2,500 more than the old match.

The average 401(k) balance has risen from $132,000 in 2013 to $287,000 in 2023, said thiele. More than 60% of employees now save at the $23,000 limit, up from 36% in 2015.