new target-date funds turn a portion of savings into payments for life

A small but growing number of companies are offering 401(k) plans that promise employees a degree of predictability, with retirement paychecks they can count on for life.

The goal is to turn a portion of retirement savings into fixed lifetime payments through target-date funds embedded with annuities.

blackrock blk 1 chief executive larry fink believes the option “will one day be the default retirement investment strategy.” his money-management firm has launched its first such funds, which fink thinks could help address the looming u.S. Retirement crisis he warned of in his annual letter this year.

Energy provider avangrid, based in connecticut, was the first company to roll out blackrock’s new lifepath paycheck funds to employees last week. Lifepath paycheck is now the default investment option in avangrid employees’ 401(k)s. Thirteen other employers have signed on to make it their default option, bringing the number of employees that will have access to the funds to 500,000.

The funds initially look like the target-date retirement funds that have become standard in u.S. 401(k) plans. They hold a riskier, stock-heavy portfolio when an employee is young, and automatically adjust toward lower-risk assets like bonds as retirement age approaches.

With lifepath paycheck, the twist is that the funds begin investing in annuity contracts at age 55. That allocation grows to roughly 30% of the portfolio by age 65. An employee has from age 59.5 until the year they turn 72 to buy an annuity with that allocation, locking in a monthly paycheck for life. The remaining 70% can remain invested in stocks and bonds or be redeemed for cash.

If the employee opts not to buy an annuity, the 30% allocation behaves similarly to the fixed-income allocation in standard target-date funds. Investors in most 401(k) plans can also eschew target-date funds entirely, and take more or less risk as they see fit.

annuities are complex, and one concern about target-date funds using them is the expense.

“there are fees in the spread of the annuity that you can’t see. That opaqueness opens itself up to the chance of litigation risk,” said jason kephart, director for multiasset ratings at morningstar.

It is why major employers are likely interested but in a wait-and-see mode, he said, given concerns about lawsuits in the litigious retirement-plan space.

“if you start to see a lot of momentum with the blackrock series, it won’t be long before more plans offer these,” kephart said.

Some 401(k) plan administrators, including fidelity, give individuals the option to convert savings into institutionally priced annuities at retirement themselves.

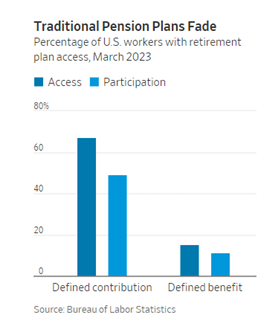

Proponents of the funds with embedded annuities say they help simplify the process of turning a retirement nest egg into an income stream that will last, without the help of a financial adviser or wealth manager. Unlike traditional pension plans, 401(k) retirement plans leave workers to figure out a withdrawal strategy themselves. That can be a source of angst for retirees. Target-date funds had an ugly 2022 when stocks and bonds fell simultaneously but rebounded quickly afterward.

“even people who know how to save for retirement still don’t know how to spend for it,” blackrock’s fink wrote in his annual letter.

As more of the baby boomer generation retires, 401(k) plan administrators have an incentive to offer products like annuities that keep retirees in their plans for longer. Keeping big accounts gives the plans more leverage with the asset managers and record-keepers they work with.

For individuals saving for retirement, blackrock says its funds help solve the complexity and expense of annuities by automatically investing in the contracts and offering access to institutional pricing. The lifepath paycheck funds are cheap—with an annual expense ratio of 0.1% until the annuity contracts are added at age 55, when the fee climbs to 0.16%.

The industry average expense ratio for target-date funds is 0.48%, according to vanguard, but the biggest providers offer funds in the 0.1% range.

There are already several products similar to lifepath paycheck, but blackrock’s has the largest uptake so far, with 14 retirement-plan sponsors signed on. Vanguard group and fidelity investments, the two largest target-date fund providers, haven’t announced plans to launch target-date funds with annuities.

“as with any new product, we will thoroughly evaluate both the investment merits and practical considerations for hybrid annuity target-date funds,” said a vanguard spokeswoman.