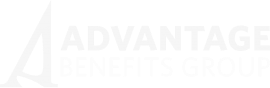

Back-to-back years of increases in premiums have added to the average cost of family coverage, reaching roughly $25,500 this year for employers and workers

Inflation is easing across much of the economy. For healthcare? Not yet.

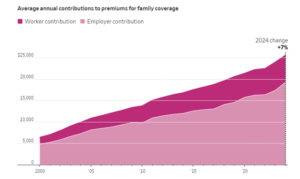

The cost of employer health insurance rose 7% for a second straight year, maintaining a growth rate not seen in more than a decade, according to an annual survey by the healthcare nonprofit KFF. The back-to-back years of rapid increases have added more than $3,000 to the average family premium, which reached roughly $25,500 this year.

Businesses absorbed this year’s higher premium costs—one of several signals in recent years that employers are sensitive to the limits of what workers can afford, said Matthew Rae, associate director of the KFF healthcare marketplace program and an author of the survey.

Employers spent about $1,880 more this year, bringing their average cost for family premiums to $19,276. Workers’ share of the average family premium dropped by roughly $280 from last year, to $6,296.

Businesses can’t keep that up, said Shawn Gremminger, chief executive of the National Alliance of Healthcare Purchaser Coalitions, an employer group. And workers ultimately bear those higher costs in other ways, he said, including smaller raises or job cuts. “That’s adding real stress to the economy,” he said.

Outlook for 2025

Stress on the sector is expected to continue, at least for another year. Employers and benefit consultants said health-insurance costs are projected to rise rapidly again in 2025.

Healthcare costs don’t change as swiftly as in other sectors of the economy, where inflation has cooled. Prices for health services are typically locked in under multiyear contracts.

In addition, hospitals have recently won new contracts with bigger price increases, which they said they need to offset raises for their own workers.

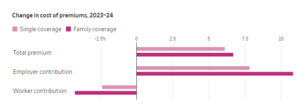

Deductibles edge upward

Increases in deductibles—the amounts employees must pay out of pocket before health insurance kicks in—was steep for years but eased more recently because the expense might already have been more than workers could afford, Rae said.

This year, however, the average deductible for large companies inched higher by 4% for workers with single coverage. Workers in smaller companies were hit harder, with deductibles rising 6%.

The average deductible for single coverage grew faster than workers’ wages in the past decade, according to KFF.

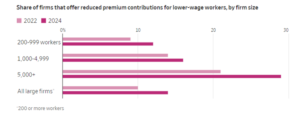

Lower-wage workers might pay less

To help workers afford health insurance, some large employers are lowering the costs for workers with lower wages.

Some large employers are also offering lower-wage workers health-insurance alternatives with skimpier benefits and low premiums. Nearly one in five of the largest employers reported having these limited plans.

Share of firms that offer reduced premium contributions for lower-wage workers, by firm size*200 or more workers

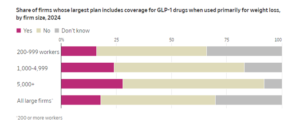

Employers hold off on weight-loss drugs

Most employers continue not to cover weight-loss drugs, according to the KFF survey. While workers are clamoring for the drugs, employers have balked because of their high costs.

Even when firms cover the drugs, that doesn’t guarantee workers unfettered access—roughly half require workers to clear hurdles before or while filling prescriptions, such as other avenues for weight loss.

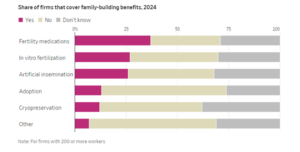

In vitro fertilization, fertility coverage are limited

Across all firms of at least 200 workers, companies that report offering fertility benefits are limited. That isn’t the case among the biggest employers.

Roughly half of the nation’s largest employers offer health benefits for fertility medications, artificial insemination or in vitro fertilization. Companies added the benefits to recruit workers during the recently tight labor market.

Survey respondents in some cases reported “don’t know” to questions about their coverage of the services.

The KFF Employer Health Benefits Survey was conducted in the first seven months of 2024 and included 2,142 employers that responded to the full survey.

Sources for graphics: KFF (employer survey); Bureau of Labor Statistics (inflation, workers’ earnings)

Source: Wall Street Journal